Dispute without a 3rd party

In rare cases where there is no 3rd party arbitration available, the challenge mechanism provides recourse for the buyer in case of a dispute.

Challenge

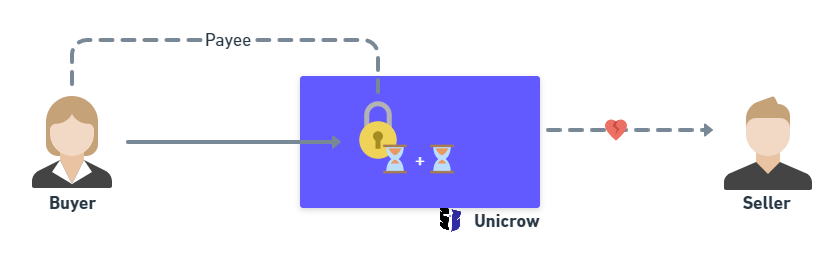

Before the challenge period ends, and before the seller has a chance to claim the payment, the buyer can challenge the payment. The challenge makes the buyer a payee of the escrow instead of the seller and extends the challenge period, so when the new challenge period ends, and the seller doesn’t challenge back, the buyer can claim a refund of the payment.

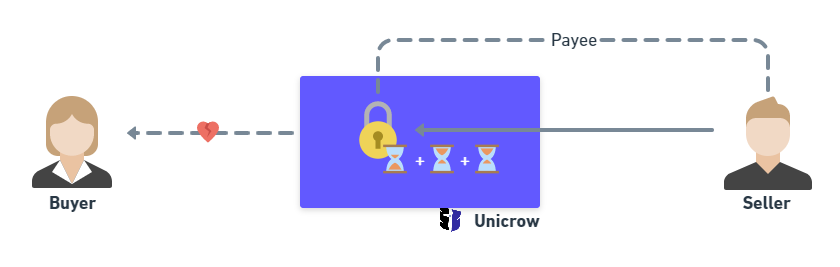

However, if the seller doesn’t agree with the challenge, the extended challenge period gives them a chance to challenge back with the same effect - now the seller is the payee and the challenge period is extended again.

This mechanism is revolutionary in that it provides escrow for situations where a 3rd party is not available or not desired, a real concern in various jurisdictions, market segments, or price points.

Challenge periods

Every new challenge period starts when the current challenge period ends. The party who was challenged can challenge when the new challenge period starts and until it ends.

The initial challenge period can be different to every new subsequent challenge period for the use-cases where that is desired.

Example

- Alice sends payment for Bob to an escrow with the following parameters:

- Initial challenge period: 2 weeks

- Challenge period extension: 1 week

- Alice is not satisfied with the goods that Bob sent, but Bob refuses to acknowledge his error.

- On day 12 (two days before the challenge period ends), Alice challenges the payment.

- Since Bob didn’t agree with Alice’s dispute to begin with, he will not accept the challenge. He waits for a couple of days until “his” challenge period starts.

- On day 15 (one day after the new challenge period starts), Bob sends his challenge.

- Alice now needs to wait six days in order to be able to send her challenge.

- At this point, they talk it through and agree that Alice will be satisfied if Bob gives her a 20% discount for the goods. They reach a settlement. Read below how that works.

Settlement

One more way how a payment can be unlocked is for the parties to agree on a settlement, i.e. on splitting the payment between them (or in other words, on seller giving discount to the buyer).

This has to be done based on a mutual on-chain consensus. Technically, this means both buyer and the seller have to send the same settlement offer to the protocol’s smart contract. When the contract checks that the two offers really match, it will settle the payment and withdraw the funds to the buyer’s and the seller’s wallet account.

Example

- Alice and Bob agreed on the 20% discount.

- Alice now sends a settlement offer where she defines that 20% of the payment goes back to her and 80% should go to Bob.

- Bob sends an approval of the settlement offer. He submits the same parameters to the protocol.

- The payment was settled, Bob received his 80% and Alice got her 20% back.